Navigating the world of banking as a student in Canada? Look no further! Our comprehensive guide dives deep into the top student chequing accounts available in Canada. Whether you’re seeking unlimited transactions, enticing welcome bonuses, or international banking perks, we’ve got you covered. Read on to discover the best banking solutions tailored to fit the unique needs of students, ensuring a smooth financial journey throughout your academic years.

What is Student Chequing Account in Canada?

In Canada, chequing accounts are bank accounts specifically designed for day-to-day transactions and accessibility. These accounts allow individuals to deposit and withdraw money, make payments through cheques or electronic transfers, and access their funds conveniently.

Chequing accounts are ideal for students as they provide access to financial services, enhance money management skills, and offer various benefits tailored to their needs.

What are Top Student Chequing Accounts in Canada?

Explore our list of the top 5 student chequing accounts in Canada chosen for their features and benefits for students

- Scotiabank Student Banking Advantage Plan

- HSBC Student Chequing

- TD Student Chequing Account

- Simplii Financial Student Banking Offer

- First Nations Bank of Canada Student Chequing Account

1. Scotiabank Student Banking Advantage Plan

Scotiabank, one of the leading banks in Canada, offers the Student Banking Advantage Plan, making it an excellent choice for students. This account provides free and unlimited chequing, allowing students to manage their money conveniently and without any additional charges. Along with this, students can also enjoy unlimited Interac e-transfers, discounts, facilitating seamless money transfers to friends, family, or vendors.

To add to its appeal, the Scotiabank Student Banking Advantage Plan allows students to earn Scene+ points on everyday purchases. Scene+ is a loyalty program that offers exciting rewards and benefits, making it more rewarding for students to use their money wisely. Scene+ allows students to redeem points for movies, dining, and more.

2. HSBC Student Chequing

HSBC, a renowned global bank, offers a student chequing account specifically tailored to meet the needs of students in Canada. With this account, students can enjoy unlimited free chequing, which means no restrictions on the number of transactions or hefty fees for making multiple payments.

Additionally, the HSBC Student Chequing account provides indefinite access to Interac e-transfers, ensuring convenient and secure money transfers with just a few clicks or taps.

For students who have international banking needs, this account offers free transfers to and from HSBC accounts abroad, facilitating seamless transactions while studying abroad or managing finances internationally. Furthermore, opening an account by November 30th, 2023, may qualify you for a welcome bonus of up to $150, making it an enticing choice for students.

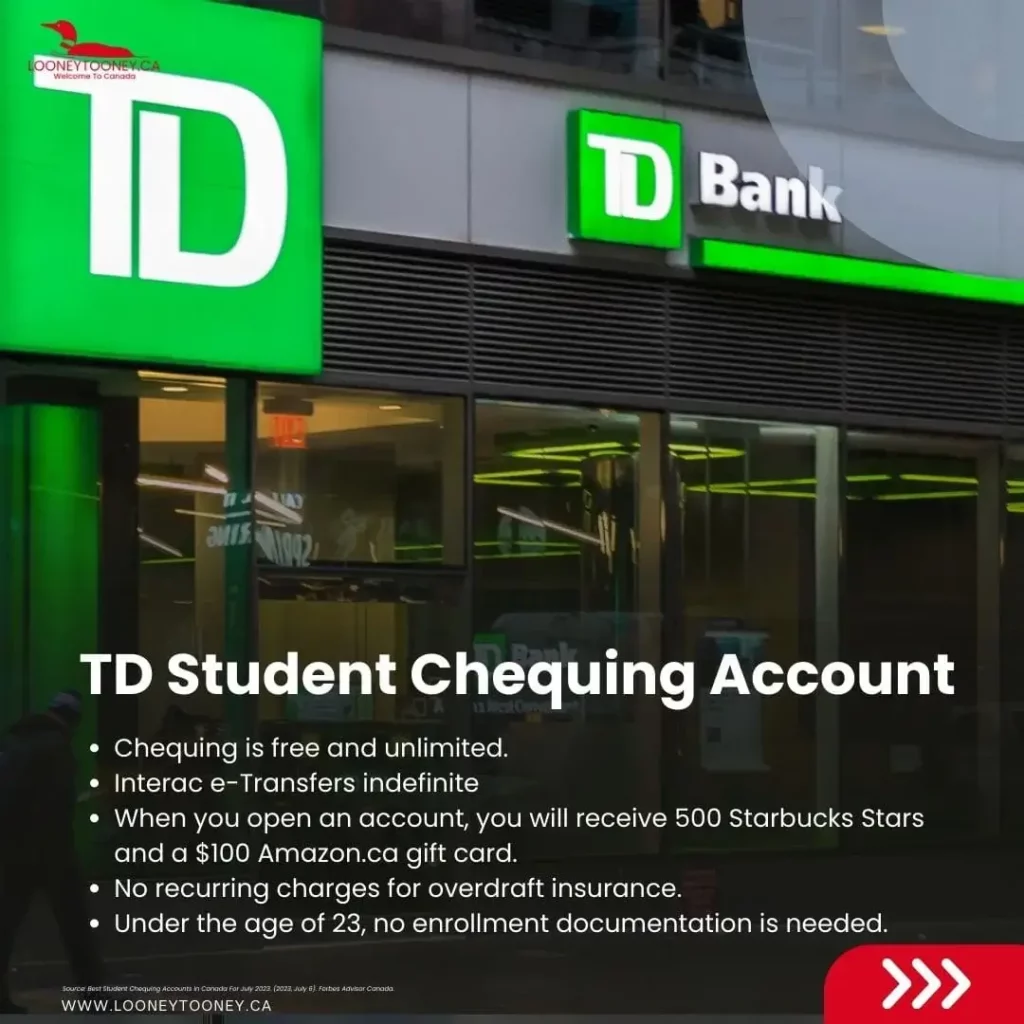

3. TD Student Chequing Account

TD Bank, also known as Toronto-Dominion Bank, is a prominent institution in Canada, offering a comprehensive range of financial services. The TD Student Chequing account is tailored specifically for students, providing them with free and unlimited chequing, ensuring easy access to their funds anytime.

Similar to other top student chequing accounts, TD Bank offers indefinite access to Interac e-transfers, allowing students to conveniently send and receive money electronically.

To make it even more appealing, opening an account with TD Bank comes with enticing perks. Students who open an account receive 500 Starbucks stars, enabling them to enjoy their favourite beverages, and a $100 Amazon.ca gift card, providing them with the flexibility to purchase essential items.

Furthermore, TD Bank does not charge recurring fees for overdraft insurance, giving students peace of mind in managing their finances responsibly. Additionally, if you are under the age of 23, no enrollment documentation is needed, simplifying the account opening process for students.

4. Simplii Financial Student Banking Offer

Simplii Financial, a subsidiary of the Canadian Imperial Bank of Commerce (CIBC), is a digital bank that focuses on delivering convenient and accessible banking services. Their Student Banking offer stands out for its simplicity and attractive features tailored for students.

With Simplii Financial’s student banking offer, students can enjoy free and unlimited chequing. This means they can carry out multiple transactions without worrying about transaction fees or limitations.

Moreover, the account includes unrestricted access to Interac e-transfers, enabling students to conveniently send money to friends, family, or vendors. Plus, they can also benefit from unlimited Interac money requests, making it easy to request money from others when needed.

An appealing aspect of Simplii Financial’s student banking offer is the welcome bonus. Students who open an account may receive a welcome bonus of $400, giving them a head start in managing their finances or pursuing their goals.

Additionally, Simplii Financial does not require proof of enrollment, making it easier for students to access the account benefits without any unnecessary documentation. Furthermore, the free chequing benefit continues even after graduation, ensuring a seamless transition into the next phase of life.

5. First Nations Bank of Canada Student Chequing Account

First Nations Bank of Canada, a leading Indigenous-owned bank, offers a student chequing account that caters to the specific needs of students. This account provides free and unlimited chequing, allowing students to manage their finances without any extra charges or restrictions.

Similar to other top student chequing accounts, the First Nations Bank of Canada Student Chequing account offers unlimited Interac e-transfers, ensuring seamless money transfers whenever needed. Additionally, students can enjoy unlimited Interac money requests, simplifying the process of requesting money from others.

Moreover, for students under the age of 23, no enrollment documentation is needed, streamlining the account opening process and making it hassle-free.

Explore the best student bank accounts in Canada and find step-by-step details for opening a student account in the article: Guide to Opening a Student Bank Account in Canada.

FAQs on Student Chequing Account in Canada

Explore some common questions about student chequing accounts in Canada and their benefits.

Q. What is a student chequing account in Canada?

A. A student chequing account in Canada is a bank account designed for students to manage their day-to-day financial transactions. These accounts offer features such as free and unlimited chequing, access to Interac e-transfers, and various benefits tailored to the needs of students.

Q. What are the best picks for a student chequing account in Canada?

A. Some of the top picks for student chequing accounts in Canada, based on features and benefits, include Scotiabank Student Banking Advantage Plan, HSBC Student Chequing, TD Student Chequing Account, Simplii Financial Student Banking Offer, and First Nations Bank of Canada Student Chequing Account.

Q. What are the eligibility criteria for opening a student chequing account in Canada?

A. Eligibility criteria can vary between banks, but typically, to open a student chequing account in Canada, you must be a full-time student, often with proof of enrollment from a recognized educational institution. Some banks may have age restrictions as well.

Q. What is the benefit of a chequing account?

A. A checking account offers several advantages, including enhanced security by eliminating the need for cash. It provides proof of payment, aiding in transaction tracking. Furthermore, responsible management of a checking account can boost your credit score. Lastly, it offers convenient access to funds without the need for physical cash.

Q. Do these student chequing accounts have any monthly fees?

A. Many student chequing accounts in Canada offer free banking with no monthly fees for students. However, it’s essential to read the terms and conditions of each bank’s specific offering, as some may have conditions or fees associated with certain transactions or services.

Check out other related articles: