Navigating the world of personal finance as a student in Canada can be a daunting task. As you embark on your educational journey, you may also be considering your first credit card. Student Credit Cards can be a powerful financial instrument, offering you a gateway to financial independence, while also providing a platform to build a solid credit history. In this comprehensive guide, we will delve into the best student credit cards Canada, meticulously examining their features, benefits, and eligibility requirements.

Canada’s higher education landscape is renowned for its diverse and globally recognized institutions, attracting students from around the world. Alongside your academic pursuits, understanding the Canadian financial system and making informed decisions about your personal finances is essential. Well-chosen Student Credit Cards can be an invaluable companion on this journey.

Table of Contents

- How we determined the best Student Credit Cards in Canada?

- The Best Student Credit Cards in Canada

- Summary of the best student credit cards in Canada

- How to Apply for Student Credit Cards: A Step-by-Step Guide

- Who Should Apply for Student Credit Cards?

- How to Make the Most of Your Student Credit Card?

- How to Compare Student Credit Cards?

- Summary: Student Credit Cards

- Frequently Asked Questions about Best Student Credit Cards in Canada

How we determined the best Student Credit Cards in Canada?

This article meticulously evaluates and selects the most outstanding credit cards, with a particular focus on their relevance to young adult Canadians. Our comprehensive description of the best student credit cards is the result of a thorough examination of numerous card attributes and features that hold significance for students. These criteria include annual fees, interest rates, introductory offers, rewards accumulation rates, income prerequisites, and additional perks such as insurance coverage, rebates, and discounts.

We understand that choosing the right Student Credit Cards is a critical financial decision, and we aim to provide you with unbiased and reliable information to facilitate your choice. To ensure transparency and clarity, we have also weighed the advantages and disadvantages of each card, assisting you in determining which one aligns best with your financial requirements and goals.

It’s important to note that our rankings are grounded in objectivity and are a trusted source of guidance for Canadians seeking to make informed credit card decisions. We want to emphasize that the inclusion of links from our affiliate partners has no influence on the outcomes of our assessments.

Now that we understand the methodology of choosing the best student credit cards in Canada, let’s explore the top options available in Canada.

Best Student Credit Cards Canada

Whether you’re interested in earning cash back, travel rewards, or simply establishing a solid credit foundation, our guide will equip you with the knowledge needed to select the best Student Credit Cards for your needs. We’ll also address key financial concepts, offer our take on the respective credit cards, and guide you through the pros and cons.

1. BMO CashBack® Mastercard®* for Students

- Annual Fee: $0

- Interest Rates: 20.99% / 22.99%

- Rewards Rate: 0.5%–5%

- Intro Offer: Up to $125

Why We Recommend It

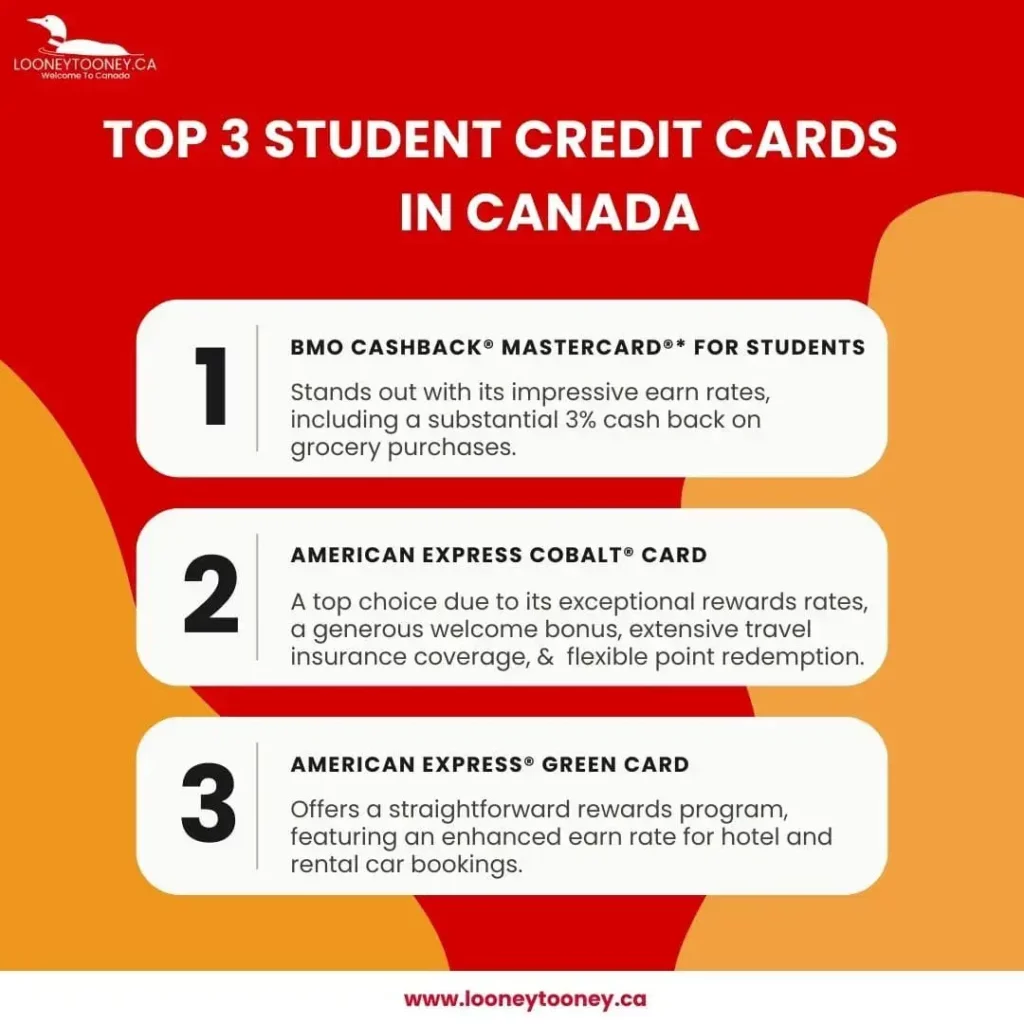

The BMO CashBack® Mastercard®* for Students stands out with its impressive earn rates, including a substantial 3% cash back on grocery purchases, all while offering valuable perks without the burden of an annual fee.

Pros

- Earn flexible and easily redeemable cash rewards on your everyday purchases.

- No minimum threshold for redeeming your cash-back rewards. Redeem as little as $1 if you desire.

Cons

- Accelerated earn rates for groceries and recurring bills are capped at $500 per billing cycle.

- Insurance coverage is limited to extended warranty and purchase protection.

Card Details

- Welcome Offer: Enjoy 5% cash back in your first 3 months.*

- Ongoing benefits include 3% cash back on grocery purchases, 1% cash back on recurring bill payments, and an unlimited 0.5% cash back on all other purchases.*

- Secure the highest cashback on groceries in Canada without the encumbrance of an annual fee.†

- With every purchase, you not only earn cash back but also embark on building a healthy credit history.

- Instantly access your cash back through direct deposit, apply it as a credit on your statement, or deposit it into your BMO InvestorLine account.*

- No Annual fee.*

- Extended Warranty.*

- Purchase Protection.*

- Enjoy discounts on car rentals.*

*Terms and conditions apply.

†Statement based on a comparison of the non-promotional grocery rewards earn rate on Canadian cash back credit cards as of January 4, 2023.

2. American Express Cobalt® Card

- Annual Fee: $155.88

- Interest Rates: 20.99% / 21.99%

- Rewards Rate: 1x-5x Points

- Intro Offer: Up to 30,000 Points

Why We Recommend It

The American Express Cobalt Card is a top choice due to its exceptional rewards rates for everyday spending, a generous welcome bonus, extensive travel insurance coverage, flexible point redemption options, and a plethora of specialty perks that keep things exciting throughout the year.

Pros

- In your inaugural year as a Cobalt Cardmember, earn 2,500 Membership Rewards® points for each monthly billing period in which you spend $500 in net purchases on your Card. This adds up to a potential 30,000 points in a year, equivalent to up to $300 towards a weekend getaway or concert tickets.

- Combine the 30,000-point introductory offer with the potential 150,000 points you can earn in your first year by spending on eats, drinks, and groceries, and you could accumulate a staggering 180,000 points in year one, ripe for redemption on travel and more.

- Effortlessly transfer the points you accrue to renowned airline and hotel loyalty programs, including Aeroplan and Marriott Bonvoy.

Cons

- Regrettably, airport lounge access is not included, which may disappoint frequent travelers.

- Travel medical coverage is not provided for card members over the age of 65.

Card Details

- Earn a remarkable 5x the points on eligible eats and drinks in Canada, encompassing groceries and food delivery.*

- Enjoy a robust 3x the points on eligible streaming subscriptions in Canada.

- Earn a commendable 2 points for every $1 spent on eligible transit and gas purchases in Canada, as well as eligible travel purchases. This equates to 2X the points on purchases facilitating your journeys.

- Accumulate 1 point for every $1 in Card purchases everywhere else. The choice is yours; we’ll simply reward you for your Card expenditures.

- Seamlessly transfer points at a 1:1 ratio to numerous frequent flyers and other loyalty programs.

- Benefit from regular Perks as a Cobalt Cardmember, including bonus reward offers and access to exclusive events.

- Enjoy Front Of The Line® Presale & Reserved Tickets for some of your favourite concerts and theatre performances, in addition to special offers and events curated exclusively for Cardmembers with American Express® Experiences.

Please be advised that effective August 15, 2023, Cobalt Cardmembers will earn 5x the points on all eligible eats and drinks charged to their Card up to $2,500 monthly, maintaining the same annual cap of $30,000 as before. This adjustment aims to deter gaming activity, and it should have minimal impact on the vast majority of Cardmembers who use the Card and Membership Rewards program as intended. Terms and conditions apply.

3. American Express® Green Card

- Annual Fee: $0

- Interest Rates: 20.99% / 21.99%

- Rewards Rate: 1x-2x Points

- Intro Offer: 10,000 Points

Why We Recommend It

The American Express Green Card offers a straightforward rewards program, featuring an enhanced earn rate for hotel and rental car bookings. Moreover, it provides the flexibility to transfer your earned points to other loyalty programs, maximizing the value of your redemptions. Notably, this eco-conscious card is crafted from 99% recycled plastic, making it a sustainable choice.

Pros

- Enjoy unlimited rewards spending with diverse redemption options, setting it apart from other no-fee rewards credit cards.

- Cardholders who relish VIP treatment will delight in the numerous perks accessible through American Express Experiences.

Cons

- Reward earn rates are comparatively lower than some other no-fee credit cards.

- It lacks some of the travel perks and insurance options offered by competing cards.

Card Details

- Secure the Card that allows you to savor the present while preparing for the future.

- As a new American Express Green Cardmember, earn a generous Welcome Bonus of 10,000 Membership Rewards® points when you charge $1,000 in purchases to your Card within the initial 3 months of Cardmembership. This translates to $100, which can be applied toward groceries or concert tickets.

- Earn a reliable 1x the points on all Card purchases.

- Make an eligible purchase with your Card and redeem your Membership Rewards points for a statement credit (Every 1,000 points equate to a $10 statement credit for all eligible purchases).

- With American Express Experiences and Front Of The Line®, American Express Cardmembers gain access to exclusive events across Canada.

- Seamlessly transfer points at a 1:1 ratio to numerous frequent flyer and other loyalty programs.

4. Scotia Momentum® No-Fee Visa* Card (for students)

- Annual Fee: $0

- Interest Rates: 19.99% / 22.99%

- Rewards Rate: 0.5%-1%

- Intro Offer: Up to $100

Why We Recommend It

The Scotia Momentum No-Fee Visa Card may not come with extravagant perks, but its absence of an annual fee makes it an attractive choice for individuals seeking to establish their credit while earning cash back on their everyday expenditures.

Pros

- Zero annual fee, making it a budget-friendly option.

- Enjoy a low 0.99% introductory interest rate on balance transfers for the first 6 months (22.99% thereafter).

- Earn up to 1% cash back on eligible purchases and recurring bill payments.

- Opportunity to secure 5% cash back for a limited time with new cards opened by October 31, 2023.

Cons

- Lacks premium perks or benefits typically found in higher-tier cards.

- The balance transfer promotion is not applicable for transferring balances from other Scotiabank Accounts.

Card Details

- Special Offer: Earn an enticing 5% cash back on all purchases for the initial 3 months (up to $2,000 in total purchases). Additionally, benefit from a 0.99% introductory interest rate on balance transfers for the first 6 months (22.99% thereafter; annual fee $0). This exclusive offer concludes on October 31, 2023.

- No annual fee, ensuring a cost-effective card ownership experience.

- Earn 1% cash back on all eligible purchases at gas stations, grocery stores, drug stores, and recurring payments.

- Garner 0.5% cash back on all other eligible expenditures.

- Enjoy savings of up to 25% off base rates at participating AVIS locations and participating Budget locations in Canada and the U.S.

- Preferred rates: 19.99% on purchases, 22.99% on cash advances.

- To qualify, a $12,000 (individual) annual income is required. Additionally, you must possess a Canadian credit file and be a Canadian resident of the age of majority in your province or territory.

Terms and Conditions Apply.

5. RBC ION+ Visa Credit Card

- Annual Fee: $48

- Interest Rates: 20.99% / 22.99%

- Rewards Rate: 1x-3x Points

- Intro Offer: 12,000 Points

Why We Recommend It

The RBC ION+ Visa is one of RBC’s latest offerings, presenting a dependable, low-fee rewards card with generous earning rates on your everyday expenditures.

Pros

- Earn unlimited 3x points in several common spending categories, including groceries, gas, food delivery, and even digital gaming.

- Receive a monthly fee rebate when you maintain an RBC Signature No Limit Banking or RBC Advantage Banking for student account.

Cons

- While insurance offerings are limited, the card does include mobile device insurance.

Card Details

- Secure a valuable 12,000 Avion welcome points upon approval¹ – equivalent to $80 in gift card value². Apply by October 31, 2023.³

- Earn 3X Avion points for every $1 spent¹ on various categories:

- Grocery, Dining & Food Delivery – Accumulate points on groceries, dining out, and food delivery.ⁱ

- Rides, Gas & EV Charging – Enjoy point accrual on gas, rideshare services, daily public transit, and electric vehicle charging.ⁱⁱ

- Streaming, Digital Gaming & Subscriptions – Stay entertained while earning points on streaming, gaming, eligible digital subscriptions, digital downloads, and in-game purchases.ⁱⁱⁱ

- Earn 1 Avion point for every $1 spent on all other qualifying purchases.¹

- The annual fee is $48², billed at $4 per month.

- Pay With Points – Redeem your Avion points to pay bills, your credit card balance, or even send money to friends via Interac e-Transfer⁴. The minimum redemption is only $10, granting you the flexibility to use your points where they are needed most.

- Save at Petro-Canada – Enjoy a 3¢/L discount on fuel and earn 20% more points when you pay with a linked RBC card.⁶

- Earn extra Be Well points at Rexall – Gain 50 Be Well points for every $1 spent on eligible purchases at Rexall when you pay with your linked RBC card and scan your Be Well card.⁷

- Save Big on Delivery with DoorDash – Receive a complimentary 3-month DashPass subscription, valued at nearly $308. This subscription offers unlimited deliveries with $0 delivery fees on qualifying orders of $15 or more when you pay with your eligible RBC credit card⁹.

- Enjoy a Monthly Fee Rebate – Receive a $4 rebate¹⁰ each month ($48/year) on the monthly fee of your credit card when you maintain an RBC Signature No Limit Banking or RBC Advantage Banking for students account.

- Mobile Device Insurance⁵ Included – Benefit from 2 years of coverage up to $1,000 in the event of loss, theft, accidental damage, or mechanical failure of your mobile device, such as your cell phone, when you purchase it with this credit card.

- Purchase Security and Extended Warranty Insurance⁵ – Automatically safeguard eligible card purchases against loss, theft, or damage within 90 days of purchase. Additionally, it doubles the manufacturer’s original Canadian warranty by up to one additional year, to a maximum of five years.

For comprehensive legal references and product terms, kindly visit the RBC website, which will be available and agreed upon during the customer onboarding process.

6. BMO AIR MILES®† Mastercard®* for Students

- Annual Fee: $0

- Interest Rates: 20.99% / 22.99%

- Rewards Rate: 0.04x-0.12x Miles

- Intro Offer: 800 Miles

Why We Recommend It

The BMO AIR MILES®† Mastercard®* for Students offers students an accessible entry into the world of AIR MILES rewards, all without the burden of an annual fee.

Pros

- Notable introductory offer for a student card, along with the opportunity to accumulate rewards on your everyday purchases.

- Your AIR MILES membership paired with this card allows you to earn miles twice as quickly at AIR MILES Partners.

Cons

- The 20.99% interest rate, while industry-standard, might seem high for first-time cardholders. If a lower rate is a priority, you may consider the nearly identical BMO AIR MILES®† Mastercard®*, which includes a 0.99% introductory interest rate on balance transfers for nine months.

Card Details

- Welcome Offer: Receive 800 AIR MILES Bonus Miles!* This translates to $80 worth of purchases with AIR MILES Cash.*

- Earn 3x the Miles for every $25 spent at participating AIR MILES Partners and 2x the Miles for every $25 spent at eligible grocery stores.*

- Accumulate 1 Mile for every $25 spent everywhere else.*

- Utilize your BMO AIR MILES Mastercard and AIR MILES Collector Card at an AIR MILES Partner to earn Reward Miles from both sources.*

- Earn AIR MILES every time you make a purchase, while also initiating the establishment of a healthy credit history.

- No annual fee.*

- Enjoy a discount on car rentals.*

- Benefit from Extended Warranty.*

- Avail of Purchase Protection.*

*Terms and conditions apply.

7. CIBC Aeroplan® Visa Card for Students

- Annual Fee: $0

- Interest Rates: 20.99% / 22.99%

- Rewards Rate: 0.67x-1x Points

- Intro Offer: 10,000 Points

Our Take

We find the CIBC Aeroplan Visa Card for Students particularly appealing for newcomers to the world of credit cards, offering a solid points accrual rate and a generous welcome bonus geared towards travel enthusiasts.

Pros

- The welcome bonus is straightforward—make a purchase and receive 10,000 Aeroplan points with no additional requirements.

- Your Aeroplan membership coupled with this card enables you to expedite point accumulation, earning points twice as quickly at Aeroplan partners and retailers in the Aeroplan eStore when you pay with your Aeroplan credit card.

Cons

- The higher 20.99% interest rate could pose challenges for students still learning to navigate their first credit card.

- To maximize value, a degree of loyalty to Air Canada and the Aeroplan rewards program is necessary.

Card Details

- Earn 1x Aeroplan point per dollar spent on gas, electric vehicle charging, groceries, and Air Canada travel purchases, up to an annual spend of $40,000.

- Continue to earn 1x Aeroplan point per $1.50 spent on all other purchases, including gas, electric vehicle charging, groceries, and Air Canada travel purchases exceeding the $40,000 threshold.

- Amplify your points through purchases at over 150 Aeroplan partners and 170+ online retailers via the Aeroplan eStore.

- Aeroplan Points are perpetual, never expiring, and are redeemable for a diverse range of travel, merchandise, gift cards, and other rewards offered by Aeroplan’s participating partners and suppliers.

- Enjoy a $0 annual fee.

- Benefit from three complimentary months of Uber Pass, offering discounts on rides, meals, and more. This offer concludes on September 8, 2022.

- Earn 1 Aeroplan point for every $6 spent on CIBC Global Money Transfer, with no transaction fees or interest provided the balance is paid on time. This offer ends on June 30, 2022.

- Maximize your point accumulation by adding up to three additional cards for family members, allowing for shared points among Aeroplan members in your household.

- Earn points by using your CIBC Aeroplan Visa to automate recurring bill payments.

- Access preferred pricing when utilizing your Aeroplan points to pay for flights.

- Enjoy savings of up to 25% on car rentals at participating Budget and Avis locations worldwide when settling the bill with your card.

- Receive up to 10 cents per litre in savings at participating Chevron, Ultramar, and Pioneer gas stations when linking your card with Journie Rewards.

- Utilize the CIBC Pace It feature to make installment payments on substantial purchases.

- The card offers four types of insurance coverage: auto rental collision and loss damage insurance, purchase security, extended protection insurance, and $100,000 in common carrier accident insurance.

- Preferred rates: 20.99% for purchases, 22.99% for cash advances.

- To qualify, you must have full-time status at a college or university.

8. Scotiabank® Scene+™ Visa* Card for Students

- Annual Fee: $0

- Interest Rates: 19.99% / 22.99%

- Rewards Rate: 1x-2x Points

- Intro Offer: 1,250 Points

Our Take

For students seeking to earn rewards that cater to their love for movies, meals, and entertainment, the Scotiabank® Scene+™ Visa* Card for Students is a fantastic no-fee introductory card.

Pros

- Scene+ points can be utilized for various purposes, including travel, shopping, and dining.

- The introductory offer is equivalent to a complimentary General Admission or 3D movie ticket in a regular auditorium.

Cons

- This card is most advantageous for cinema enthusiasts. If you do not enjoy going to the movies or have concerns about frequenting theaters during COVID-19, the card’s value may be limited.

Card Details

- Earn 2x Scene+ points per dollar spent at Cineplex and cineplex.com, with limits of up to 300 points per transaction and a maximum of 600 points per day.

- Collect 1x Scene+ point per dollar spent on everyday credit card purchases.

- Acquire 2X Scene+ points for every dollar charged to your account on all eligible purchases¹ at select grocery stores, including Sobeys, IGA, Safeway, and others.

- Scene+ points can be redeemed for various options, such as travel, shopping, dining, statement credits, Cineplex entertainment, and more.

- Enjoy a $0 annual fee.

- Benefit from potential savings of up to 25% off base rates at participating AVIS locations and participating Budget locations in Canada and the U.S. Please note that insurance coverage is not included.

- No insurance coverage is provided.

- Preferred rates: 19.99% for purchases, 22.99% for cash advances.

- To qualify, you must be a resident of Canada and of the age of majority in your province or territory. Credit history is not mandatory, and international students are eligible to apply.

9. CIBC Aventura® Visa Card for Students

- Annual Fee: $0

- Interest Rates: 20.99% / 22.99%

- Rewards Rate: 0.5x-1x Points

- Intro Offer: Up to 2,500 Points

Our Take

The CIBC Aventura Visa Card for Students is a wise choice for students seeking a no-fee card that provides flexible travel rewards on their everyday purchases.

Pros

- Earn points on every purchase you make.

- Gain access to personalized travel booking and trip planning services through the Aventura Travel Assistant.

Cons

- The earn rate for purchases at gas stations, electric vehicle charging stations, grocery stores, and drugstores is limited to an annual spend of $6,000.

- The higher 20.99% interest rate could pose challenges for students who are new to managing their first credit card.

Card Details

- Earn 1 Aventura point for every $1 spent at gas stations, electric vehicle charging stations, grocery stores, and drugstores, up to an annual spend of $6,000.

- Get 1 Aventura point for every $1 spent on travel purchased through the CIBC Rewards Centre.

- Earn 1 Aventura point for every $2 spent on all other purchases.

- Redeem your Aventura points for various options, including covering the full cost of airfare, including taxes and fees, reducing your balance, or enjoying travel rewards from the CIBC Rewards Centre, such as hotel stays, vacation packages, cruises, merchandise, gift cards, and unique experiences. Aventura points do not expire as long as your account remains in good standing.

- There is no annual fee.

- Save up to 10 cents per litre on gas at Chevron, Ultramar, and Pioneer gas stations when you link your card with Journie Rewards.

- Enter the Student Life Network Full Ride Contest by December 31, 2022, for a chance to win $35,000 for tuition.

- Qualify for a complimentary SPC membership and gain exclusive access to SPC+ for discounts, access to over 450 deals, special experiences, and more.

- Utilize the CIBC Pace It feature to make installment payments on significant purchases.

- The card offers four types of insurance coverage: auto rental collision and loss damage insurance, purchase security, extended protection insurance, and $100,000 in common carrier accident insurance.

- Preferred rates: 20.99% for purchases, 22.99% for cash advances.

- Eligibility requires full-time enrollment in a college or university.

10. Tangerine Money-Back Credit Card

- Annual Fee: $0

- Interest Rates: 19.95%

- Rewards Rate: 0.5%-10%

- Intro Offer: Up to $100

Our Take

The Tangerine Money-Back Credit Card is a noteworthy choice for those who desire limitless cash back at a competitive 2% rate across up to three personally selected spending categories, alongside a steady 0.50% cash back on all other purchases.

Pros

- Enjoy the flexibility to tailor your 2% cash back rewards to match your spending habits by choosing up to three categories from Tangerine’s selection of 10, encompassing essentials such as gas and groceries, as well as unique options like furniture and home improvement.

- Benefit from a special balance transfer offer: Transfer balances within your initial 30 days and pay only 1.95% interest on the transferred balance for the first six months (which adjusts to 19.95% thereafter).

Cons

- While a 2% cash back rate is competitive, some cards offer double rewards on specific categories.

- Tangerine operates solely as a virtual bank, lacking physical bank branches.

Card Details

- Earn 2% cash back in two categories of your choice, selected from Tangerine’s list of options, which includes groceries, furniture, restaurants, hotel-motel stays, gas, recurring bill payments, drug store purchases, home improvement expenses, entertainment costs, and public transportation and parking expenditures.

- Opt for a third cash-back category by electing to have your rewards deposited into a Tangerine Savings Account.

- Receive 0.50% cash back on all other eligible purchases.

- Redeem your cash back monthly as a statement credit or have it deposited into a Tangerine Savings Account.

- Enjoy the benefits of this card without an annual fee.

- Avail of the balance transfer promotion: Transfer your balances within the first 30 days and pay only 1.95% interest on the transferred amount for the initial six months (with a 1% balance transfer fee applicable).

- Obtain complimentary additional cards for authorized users on your account.

- The card provides purchase assurance and extended protection insurance. For more extensive insurance coverage, consider the Tangerine World Mastercard, available to applicants with a minimum personal income of $60,000. When applying for the Money-Back card, meeting this requirement automatically qualifies you for consideration for the World card.

- Preferred rates: 19.95% for purchases and cash advances.

- Eligibility mandates a $12,000 (individual) annual income, a Canadian credit file, and Canadian residency at the age of majority in your province or territory of residence.

Summary of the best student credit cards in Canada

| Student Credit Cards | CARD FEATURES | ANNUAL FEE |

| BMO CashBack® Mastercard®* for Students | Best overall card for students. | $0 |

| CIBC Aeroplan® Visa Card for Students | Best for: Aeroplan points. | $0 |

| Tangerine Money-Back Credit Card | Best for: Customizable spending categories. | $0 |

| American Express Green Card | Best for: Flat-rate reward points. | $0 |

| American Express Cobalt® Card | Best for: Points on restaurants. | $155.88 |

| RBC ION+ Visa Credit Card | Best for: Low annual fee. | $48 |

| Scotiabank® Scene+™ Visa* Card for Students | Best for: Newcomers. | $0 |

| BMO AIR MILES®† Mastercard®* for Students | Best for: AIR MILES points. | $0 |

| CIBC Aventura Visa Card for Students | Best for: Aventura points. | $0 |

| Scotia Momentum No-Fee Visa Card (for students) | Best for: Balance transfers. | $0 |

How to Apply for Student Credit Cards: A Step-by-Step Guide

Before you embark on the journey of applying for Student Credit Cards, it’s crucial to understand that certain criteria must be met to be eligible. Here’s a breakdown of the key factors you need to consider:

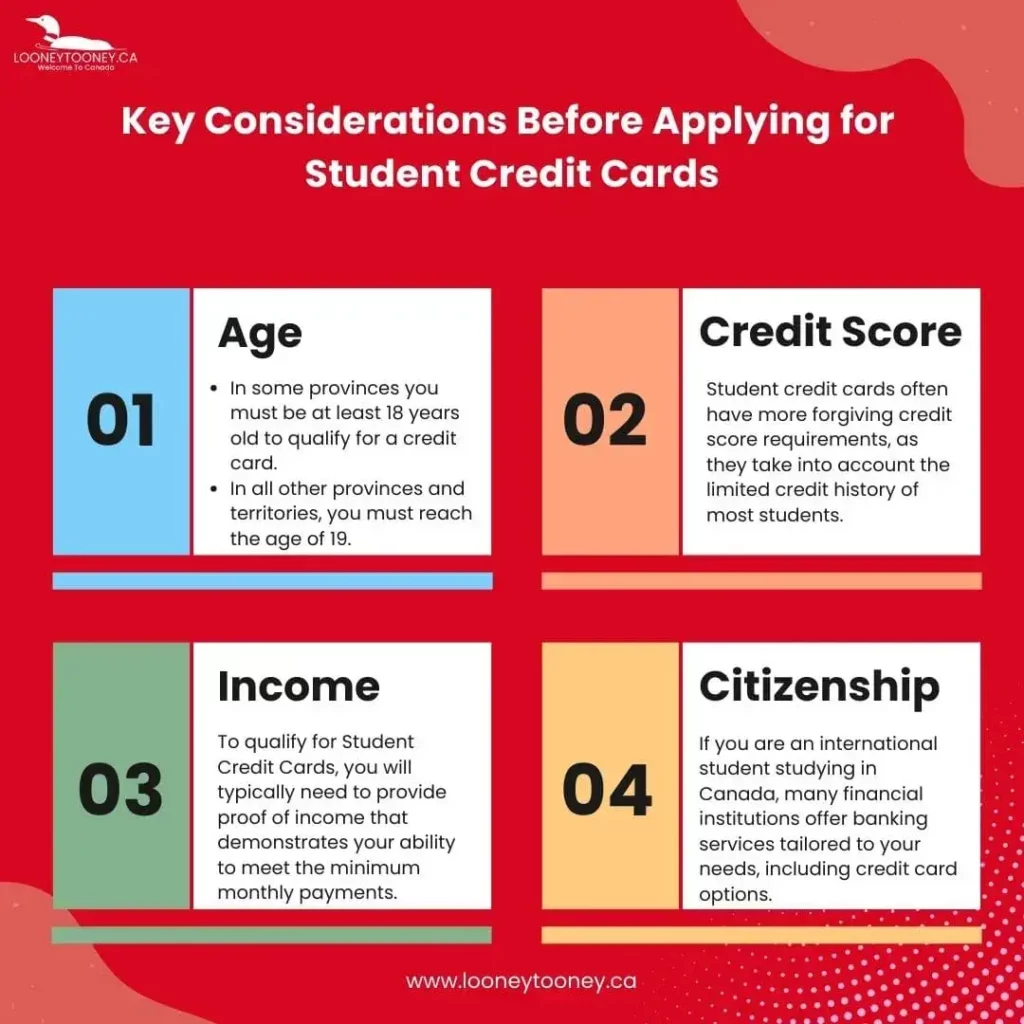

1. Age:

- In Alberta, Manitoba, Ontario, Quebec, and PEI, you must be at least 18 years old to qualify for a credit card.

- In all other provinces and territories, you must reach the age of 19.

- For students under the age of 18, there are alternative options such as obtaining a supplementary card on a parent or guardian’s account or qualifying for a prepaid/reloadable credit card.

2. Credit Score:

- Student credit cards often have more forgiving credit score requirements, as they take into account the limited credit history of most students. However, approval is not guaranteed, and a basic credit assessment will still be conducted.

3. Income:

- To qualify for Student Credit Cards, you will typically need to provide proof of income that demonstrates your ability to meet the minimum monthly payments. This income requirement ensures responsible credit card usage.

4. Residency and Student Status:

- Generally, you must establish that you are a Canadian resident or citizen and currently enrolled as a student to be eligible for a student-specific credit card.

- If you are an international student studying in Canada, many financial institutions offer banking services tailored to your needs, including credit card options. You will likely need to show proof of enrollment in a Canadian post-secondary institution.

Who Should Apply for Student Credit Cards?

Applying for student credit cards is a significant financial decision and should be undertaken with responsibility. Only students who are confident in their ability to manage credit and make at least the minimum monthly payments should consider applying for student credit cards. It’s a valuable tool for building credit, but misuse can lead to financial challenges. Therefore, thoughtful consideration and responsible financial habits are essential for those seeking to benefit from student credit cards.

How to Make the Most of Your Student Credit Card?

Getting a student credit card is a crucial move for financial independence and credit history. To maximize benefits, follow this comprehensive plan for responsible financial habits.

1. Understand Your Card: Familiarize yourself with the terms and conditions of your student credit card, including interest rates, fees, and any introductory offers. Understanding your card’s features will help you use it wisely.

2. Set a Budget: Create a monthly budget that outlines your income and expenses. Stick to this budget to ensure you can comfortably make payments on your credit card and avoid accumulating debt.

3. Pay On Time, Every Time: Timely payments are crucial for maintaining a positive credit history. Set up payment reminders or automatic payments to ensure you never miss a due date.

4. Pay in Full: Whenever possible, pay your credit card balance in full each month. This practice helps you avoid paying interest and accumulating debt.

5. Monitor Your Spending: Keep track of your credit card transactions to understand your spending patterns. Many credit card providers offer mobile apps or online account access for easy monitoring.

6. Responsible Credit Utilization: Aim to keep your credit utilization ratio (credit used compared to your credit limit) below 30%. This demonstrates responsible credit management and positively impacts your credit score.

7. Take Advantage of Rewards: If your Student Credit Cards offers rewards, make the most of them. Choose rewards that align with your spending habits, whether it’s cash back, travel points, or other perks.

8. Avoid Cash Advances: Cash advances often come with high fees and interest rates. Avoid using your credit card for cash withdrawals whenever possible.

9. Stay Within Your Limit: Avoid maxing out your credit card. Keeping your balance well below the credit limit shows responsible credit management.

10. Build Credit Wisely: Building a strong credit history takes time. Be patient, and avoid opening multiple credit accounts simultaneously.

How to Compare Student Credit Cards?

When choosing Student Credit Cards, it’s essential to compare your options carefully to find the one that best suits your financial needs and lifestyle. Here’s a step-by-step guide on how to compare student credit cards effectively:

1. Determine Your Goals:- Before diving into card comparisons, define your financial goals. Are you looking to build credit, earn rewards, or minimize fees and interest rates? Understanding your objectives will help you narrow down your choices.

2. Check Eligibility Requirements:- Review the eligibility criteria for each card, including age, income, and student status. Ensure you meet these requirements before proceeding.

3. Interest Rates:- Compare the annual interest rates (APR) for purchases and cash advances. Lower interest rates can save you money in the long run.

4. Fees:- Examine the fee structure, including annual fees, foreign transaction fees, and balance transfer fees. Opt for a card with minimal fees, especially if you plan to carry a balance.

5. Rewards and Perks:- Evaluate the rewards program offered by each card. Consider whether you prefer cash back, travel rewards, or other perks. Look for cards that align with your spending habits and offer rewards you value.

6. Credit Limit:- Understand the credit limit offered by each card. A higher limit can be beneficial, but it’s essential to use it responsibly.

7. Introductory Offers:- Some student credit cards come with introductory offers such as cash back bonuses or low introductory interest rates. Take advantage of these if they align with your needs.

8. Credit Building Opportunities:- Look for features that promote responsible credit building, such as free credit score monitoring or credit education resources.

9. Additional Benefits:- Consider any additional benefits, such as purchase protection, extended warranties, or access to exclusive events, that come with the card.

10. Online Account Access: – Check if the card offers convenient online account management tools, such as mobile apps or web access, to monitor your transactions and payments.

11. Customer Service: – Research the reputation of the credit card provider for customer service quality and responsiveness.

12. Compare Multiple Options: – Don’t settle for the first card you come across. Compare at least three different student credit cards to find the one that best aligns with your goals and preferences.

Summary: Student Credit Cards

In conclusion, the selection of a student credit card in Canada is a significant decision that can contribute to financial autonomy. With options catering to diverse preferences, from cash-back rewards to travel points and customizable spending categories, students have the flexibility to choose a card that suits their lifestyle. Additionally, students can also take advantage of various student discounts available in Canada, further enhancing their ability to manage their finances wisely and make the most of their time in the country.

For a comprehensive guide to enhancing life in Canada, international students can explore the “Ultimate Guide for International Students in Canada.” This resource provides valuable insights to ease their stay and improve their overall experience in the country.

Frequently Asked Questions about Best Student Credit Cards in Canada

Here are answers to common queries about the best student credit cards in Canada

Q. Can a student get credit card in Canada?

A. Yes, students can get a credit card in Canada. Many financial institutions offer student-specific credit cards with features tailored to their needs.

Q. Which credit card is better for student?

A. Choosing the best credit card for a student depends on individual preferences and needs. Some popular options include the BMO CashBack® Mastercard®* for Students, the CIBC Aeroplan® Visa Card for Students, and the Tangerine Money-Back Credit Card.

Q. What factors determine eligibility for student credit cards?

A. To be eligible for student credit cards, individuals must meet specific criteria, including age requirements, maintaining a suitable credit score, presenting proof of income, and either demonstrating Canadian residency or enrolling in a Canadian post-secondary institution.

Q. How can students apply for student credit cards?

A. To apply for student credit cards, students should understand the eligibility criteria, gather the necessary documents, and choose a card that suits their needs. The process involves providing personal information, proof of income, and details about enrollment or residency.